EM 2021 live im TV und Livestream: So läuft das Halbfinale Italien vs. Spanien heute | DAZN News Deutschland

Fußball-EM 2021: München behält Spiele - wohl 14.500 Fans zugelassen - Sport Nachrichten zu Eishockey, Wintersport und mehr - Allgäuer Zeitung

England Ukraine Übertragung heute: Live-Stream und Free-TV, Spielort und Schiedsrichter – So seht ihr das EM-Viertelfinale | Südwest Presse Online

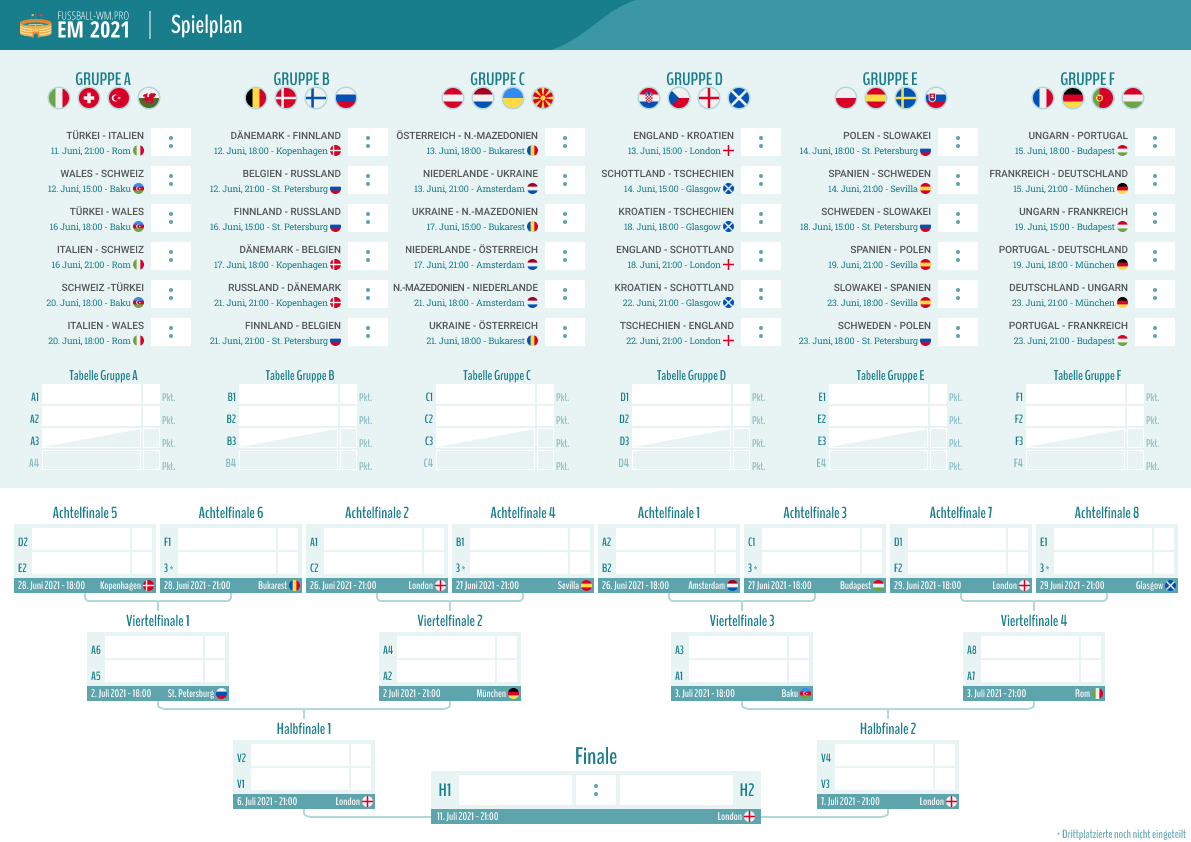

EM-Spielplan 2021: Alle Spiele, alle Ergebnisse, alle Termine, alle Stadien - Kalender zur EURO 2020 - Eurosport

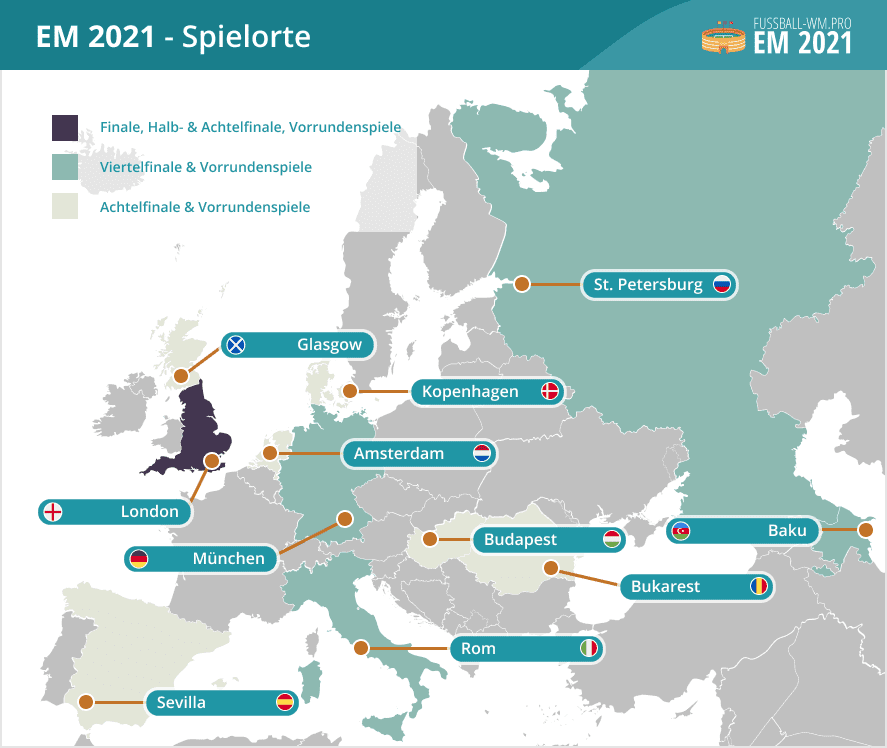

EM-Finale 2021 heute am 11.7.21: Austragungsorte, Stadien, Spielstätten und Orte der Fußball Europameisterschaft 2021

Grünes Licht: München bleibt Spielort der verlegten Fußball-EM 2021 - Tickets behalten Gültigkeit - Sportbuzzer.de

Fußball-EM 2024: Spielorte, Tickets, Finale - Europameisterschaft in Deutschland | Südwest Presse Online

:focal(1277x801:1279x799)/origin-imgresizer.eurosport.com/2019/11/18/2719178-56205590-2560-1440.jpg)

EM-Spielplan 2021: Alle Spiele, alle Ergebnisse, alle Termine, alle Stadien - Kalender zur EURO 2020 - Eurosport