MedX5 (Upgrade 2020) SET (0,25mm + 0,5mm + 1mm +1,5mm) Dermaroller, 540 Nadeln aus Edelstahl, Derma Roller gegen tiefe Narben und schwere Cellulite : Amazon.de: Beauty

MedX5 (Upgrade 2019) 3in1 Dermaroller with 1,5mm, 1mm, 0,5mm (stainless steel needles), Derma roller against deep scars and cellulite, Medical Device Class I with CE - Buy Online - 66992397

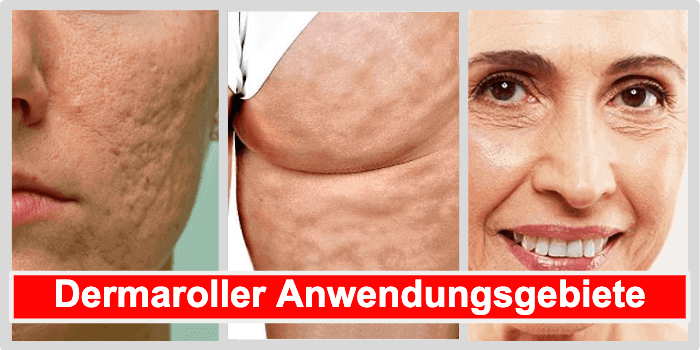

MedX5 (Upgrade 2020) SET (0,25mm + 0,5mm + 1mm +1,5mm) Dermaroller, 540 Nadeln aus Edelstahl, Derma Roller gegen tiefe Narben und schwere Cellulite : Amazon.de: Beauty

MedX5 (Upgrade 2019) Dermaroller SET (0,25mm, 0,5mm, 1mm, 1,5mm) (540 stainless steel needles), Derma roller against deep scars and cellulite, Medical Device Class I with CE : Amazon.co.uk: Beauty

MedX5 (Upgrade 2020) SET (0,25mm + 0,5mm + 1mm +1,5mm) Dermaroller, 540 Nadeln aus Edelstahl, Derma Roller gegen tiefe Narben und schwere Cellulite : Amazon.de: Beauty