Kinderbett / Jugendbett Milo 26 inkl. 2 Schubladen, Farbe: Weiß / Grau, teilmassiv, Liegefläche: 80 x 190 cm (

Feldmann-Wohnen Bett »KOMBI«, Liegefläche: 80 x 190 cm, - in der Farbe Cappuccino online kaufen | OTTO

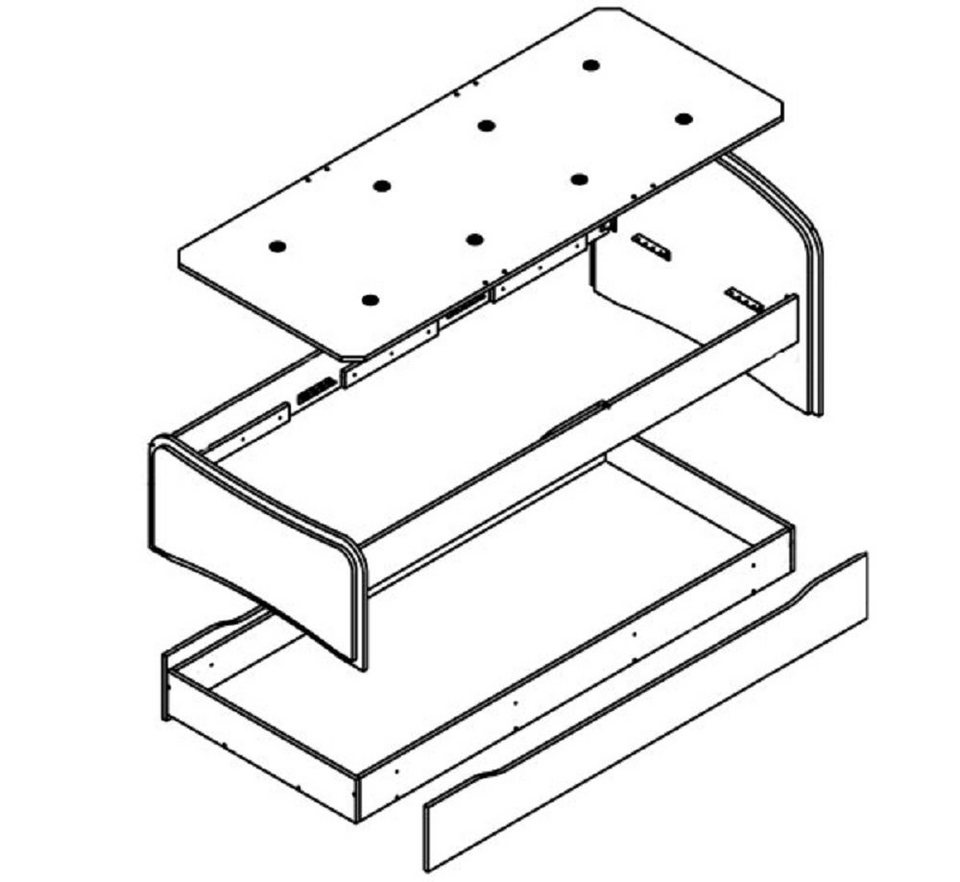

Bettkasten für Kinderbett / Jugendbett Peter 01, Farbe: Kiefer Weiß / Türkis - Liegefläche: 80 x 190 cm (B x L)

Ausziehbett 80 x 190 cm mit Matratze – Massivholz Natur Weiß Holz : Amazon.de: Küche, Haushalt & Wohnen

Stabiles Stapelbett in kompakter Form 80x190 Massivholz Kiefer mit Rollrost 60.56-08-190 | Stapelbetten / Funktionsbetten | Betten | Möbel | Erst-Holz ®

EVERGREENWEB - Bett Lattenrost 80x190 Einzelbett Höhe 35 cm Orthopädisches Extra Komfort Leisten Holz mit 4 Abnehmbar Füße, Verstärkte Rahmen aus Stahl Bettgestell geeignet für alle Betten & Matratzen : Amazon.de: Küche,