Pandora - ¡Os presentamos al encantador equipo de la boutique PANDORA en Málaga en el C.C. Larios! | Facebook

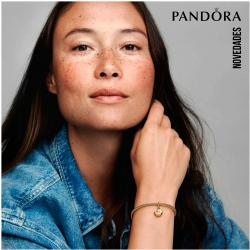

Sign with Different Watch Companies. TAG Heuer, Longines , RADO , Gucci, Pandora Editorial Stock Photo - Image of classic, background: 241480028